Policy

HIS Group considers "Reinforcement of Governance" to be a materiality, and we aspire to be a company which is trusted and chosen by stakeholders based on the HIS Group Philosophy.

In addition, each employee is working to engender a corporate culture and climate which respects the HIS Charter of Corporate Behavior and the rights and positions of every stakeholder

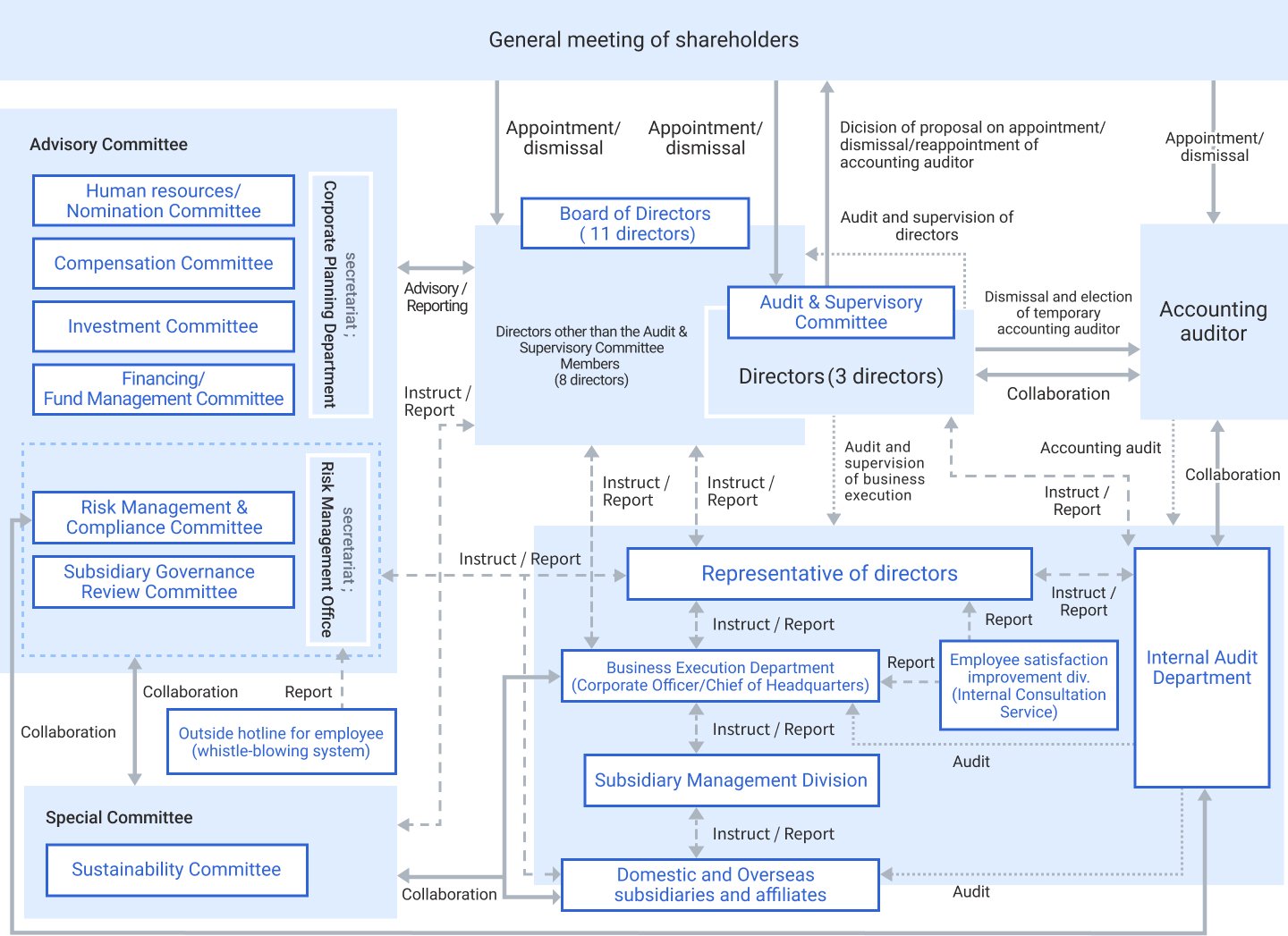

Corporate governance system

The Board of Directors makes major operational decisions by resolution following laws, the Articles of Incorporation, and internal regulations and is informed of each director's operations and the business performances of the major group companies.

Each Director consistently executes his/her duties efficiently by making appropriate and prompt decisions following his/her role and authority under the Regulations of the Board of Directors, the Regulations on Division of Duties, the Regulations on Administrative Authority, and other regulations.

Important matters, such as resolutions of the Board of Directors, are adequately retained, recorded, and managed by the authorized and responsible department and are appropriately disclosed following laws and regulations or the timely disclosure rules of financial instruments exchanges or when the company deems such disclosure effective for shareholders and investors to make appropriate judgments.

The Supervisory Committee periodically holds discussions with the Representative Director and other members of the Board and receives reports from the Auditor on a regular basis.

The Internal Audit Department is required to work closely with the Supervisory Committee to ensure that effective audits by the Supervisory Committee are carriaed out appropriately, to conduct internal audits under the direction of the Supervisory Committee as necessary, and to report the results to the Supervisory Committee.

Organizational audits by the Supervisory Committee using an internal control audit system, etc., are conducted effectively, and the Audit Department (internal audit department) fulfills its intended role.

Diagram of Corporate Governance System

Deliberations of the Board of Directors

The board of directors conducts deliberations, etc., on the approval of quarterly financial results, management systems, financial policy, investments, and M&A proposals based on the regulations of the board of directors in addition to legal requirements.

They also receive regular reports from each board member on their area of responsibility, as well as performance reports and reports on future business plans from representatives of each group company.

In FY2023, when drafting a business strategy to return to profitability and the mid-term business plan for FY2024-2026 announced in December 2023 in response to the recovery period from the coronavirus pandemic, the board adopted a three-year policy of "challenging new areas" to restructure our portfolio and innovate on core areas centering on travel business, and engaged in focused deliberations.

To revitalize the deliberations of the board of directors, the corporate planning department created a space for information exchange with the four independent outside directors either directly or through dedicated staff on auditing committees, etc., to promote mutual confirmation in order to enable sharing objective knowledge and strengthening recommendations.

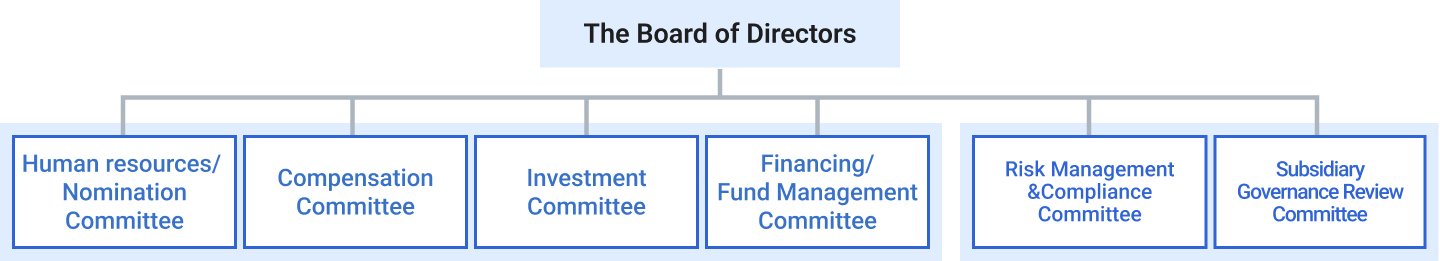

Advisory committee

The Board of Directors has four committees as Advisory Committees.

The Human resources / Nomination Committee the consideration of director and executive positions, the Compensation Committee matters of compensation for directors and executives, the Investment Committee is to deliberate matters of investment, the Financing/ Fund Management Committee important matters concerning fundraising and fund operations.

After each committee has deliberated, the findings of each will be presented to the Board of Directors for deliberation and resolution.

The Board of Directors respects the reports of each committee and passes resolutions.

We are also proceeding with discussions to strengthen the objectivity and independence of each committee, such as the composition ratio of independent outside directors on Advisory Committees.

The Board of Directors effectiveness evaluation

Once a year, each company director is to conduct a self-evaluation using a signed questionnaire. The Board of Directors is to analyze and consider this evaluation and move toward further improvements.

Main improvements in FY2023

・Increased diversity among Outside Director has led to livelier discussions at the Board of Directors

・HIS Group Philosophy is now available in multiple languages and is becoming widespread throughout the group.

・The Risk / Compliance Committee began to meet regularly, which led to stronger governance.

Future challenges to address

・Discussion towards formulating a successor training plan

・Development of policies and implementation plans to improve diversity of Directors (gender, nationality, etc.)

・Progress management of the medium-term management plan and deliberations toward restructuring the business portfolio

・Discussion including quantitative targets for non-financial information such as sustainability

Executive Remuneration

At its Board of Directors meeting held on February 25, 2021, the Company adopted a policy to determine remuneration, etc. for individual directors of the Company.

Rules related to remuneration calculation method and determination of remuneration

Remuneration amounts paid by the Company to its officers are set within the overall limit of remuneration approved by the General Meeting of Shareholders.

The amounts allocated to directors (excluding directors serving as members of the Audit & Supervisory Committee) are determined by the Board of Directors based on recommendations from the Compensation Committee, and the amounts allocated to directors who concurrently serve as members of the Audit & Supervisory Committee are determined through deliberation by members of the Audit & Supervisory Committee.

The policy for determining remuneration amounts is in accordance with the internal remuneration regulations established through deliberation by the Board of Directors and members of the Audit & Supervisory Committee and covers provisions related to the remuneration structure, remuneration determination criteria, and standard remuneration amounts.

Remuneration policy

To have in place a competitive remuneration system with high degree of fairness

Remuneration system and levels that are based on work responsibilities and performance (regardless of nationality or gender), and contribute to the acquisition and retention of outstanding human resources

To have in place a remuneration system focused on improving corporate and shareholder value

Remuneration system and structure that is closely correlated to earnings performance and focuses on improving medium- to long-term corporate and shareholder value

Remuneration system for the Company's directors (excluding directors serving as members of the Audit & Supervisory Committee)

Fixed Remuneration

| Basic monthly remuneration | The Company determines amounts commensurate with directors' roles and positions, and pays these as basic monthly remuneration. |

|---|

Variable Remuneration

| Performance-linked remuneration (linked to ordinary profit) |

To calculate performance-linked remuneration, the Company uses the average of the three highest ordinary profit amounts recorded in the last 10 consolidated fiscal years as a reference value. As a rule, the Company pays an amount equivalent to 7% of the amount obtained by subtracting this reference value from the ordinary profit amount for the current fiscal year. However, based on earning performance trends, the Company may adjust the abovementioned 7% by 1-2 points. ・Concrete amounts are determined within a range of 0-200% of the standard amount in accordance with the degree of earnings achievement in each fiscal year. ・Paid as a lump-sum at the end of each fiscal year |

|---|---|

| Stock option | The Company has established a stock option program as a form of remuneration that aims to enhance corporate value over the medium to long term. The total amount is kept within the annual amount (within 100 million yen) approved by the General Meeting of Shareholders. |

| Restricted stock compensation | The Company allots restricted stock to directors (excluding directors serving as members of the Audit & Supervisory Committee, non-executive directors, part-time directors, and outside directors), and accordingly aims to motivate directors to work toward continuous improvement of corporate value, and further align their interests with those of its shareholders. (The total amount is kept within the annual amount [within 100 million yen] approved by the General Meeting of Shareholders.) ・Standard amount is calculated as monthly remuneration × multiple based on position at the Company |

As a result of the significant impact of the global COVID-19 pandemic on business performance, the remuneration, etc. for individual directors in FY2023 was not based on the remuneration composition above, but was reviewed by the Compensation Committee, and deliberated and determined by the Board of Directors.

Remuneration composition

| Basic remuneration | Directors bonuses | Stock-based compensation | ||

|---|---|---|---|---|

| Remuneration type | Basic monthly remuneration | Performance-linked remuneration | Stock option | Restricted stock compensation |

| Share of remuneration | 40%-48% | 32%-40% | 5%-9% | 11%-15% |

| Time of payment | Monthly | Once a year | Upon completion of medium-term management plan | Upon retirement of each officer |

| Performance-linked or not | Fixed | Performance-linked | Performance-linked | Not linked to performance |